Homebridge is making significant improvements and minor updates to the Elite Access (Non-QM) program.

Overview

- Three new documentation options have been added:

-

- Investor Cash Flow (highlights included below)

- 1099 Only: 1 or 2 years (see guides for complete details)

- P&L Only (see guides for complete details)

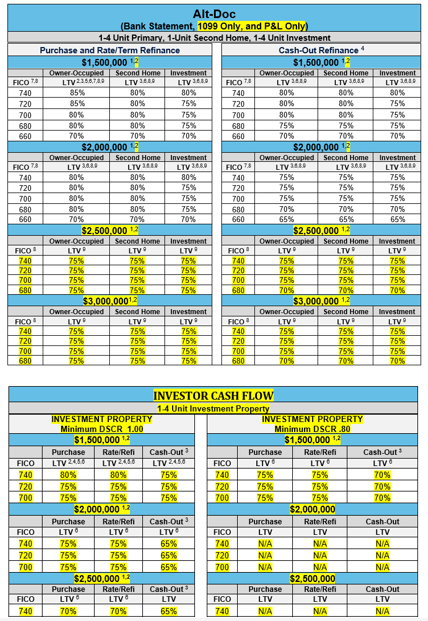

NOTE: Refer to matrices included on page 3 for credit score, LTV, loan amount details

- Maximum loan amount increased to $3,000,000 (all documentation options – existing and new)

- Interest-only feature now eligible

-

- Full and Alt-Doc Options: Maximum 80% LTV

- ICF Option: Maximum 75% LTV

- Minimum 680 credit score (ICF minimum 700 credit score)

- FTHBs ineligible for IO feature

- Non-occupant co-borrowers allowed

- Tradeline requirements updated to allow two traditional tradelines with a 24 month credit history (current requirement is three traditional tradelines with 12 month history)

-

- If the borrower’s spouse is the only co-borrower on the loan, only one borrower is required to meet the above minimum tradeline requirement

- A 10% minimum borrower contribution is no longer required on primary residence transactions; 100% of funds required may come from a gift

- Mortgage/rental history has been updated to allow the following:

-

- Full Doc and Alt Doc Transactions: 1×30 in previous 12 months with a maximum 80% LTV (previously 0x30x12)

- Investor Cash Flow Transactions: 1×30 in previous 12 months with a maximum 75% LTV

- First time home buyers: The requirement that FTHB living rent-free to provide a 12- month history from prior to the rent-free period has been removed

- Non-warrantable condos now allowed

-

- Maximum 75% LTV

- Delayed financing now available

- Bank Statement Option:

- Borrowers using personal bank statements are no longer required to be qualified with just Uniform Expense Ration method; all methods are eligible

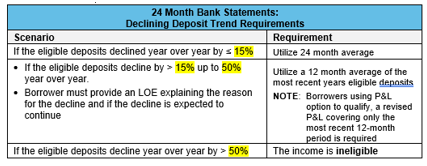

- The income trend topic 24 months bank statement has been updated as noted below:

Investor Cash Flow Specific

- Maximum 80% LTV

- Maximum loan amount $3,000,000

- Minimum loan amount $100,000

- Minimum 700 credit score

- Minimum DSCR .80. < 1.00 DSCR the following applies:

-

- Maximum $1,500,000 loan amount

- IO not eligible

- Interest-only available subject to:

-

- Maximum $2,000,000 loan amount

- Maximum 75% LTV

- Minimum 1.00 DSCR required

- Unlicensed MLOs eligible with no LTV restriction

- Short-term rental income not eligible

Updates

- Asset Depletion renamed to Asset Qualifier

-

- Maximum LTV 75% (previously 80%)

- IO feature eligible on primary residence transactions only

- Loan amounts < $150,000 maximum 80% LTV (previously no limitation)

- Prepayment penalty no longer available in Kansas

- P&L Only Option: Maximum payment shock 100% regardless of DTI. Payment shock requirements apply to first time home buyers and non-first time home buyers:

- Primary residence purchase and refinance transactions, and

- Second home refinance transactions and investment property refinance transactions

- First time home buyers (FTHB) living rent-free are ineligible on investment properties (new)

- Clarified that FTHB are eligible on primary residence transactions only; they are ineligible on second home and investment transactions

New Documentation Option Matrices

These updates are effective immediately and may be applied to new submissions and loans currently in the pipeline.

The updated Elite Access guidelines have been posted on the Homebridge Wholesale website.

If you have any questions, please contact your Account Executive.