Fannie Mae announced enhancements to their multiple financed property guidance in Announcement SEL-2016-03. The updated policy is effective immediately but will not be implemented in DU until the release of DU Version 10.0 scheduled for June 25, 2016.

Fannie Mae has removed the LTV/CLTV and credit score overlays that applied when the borrower is purchasing a second home or investment property and lowered the reserve requirements.

The following applies to second home and investment transactions when the borrower owns multiple financed properties:

- Purchase, rate/term, and cash-out transactions eligible (previously cash-out was only eligible using Delayed Financing)

- The credit score overlay was removed except for borrowers with 7-10 financed properties; Fannie Mae standard credit score requirements now apply for borrowers with 1-6 financed properties. Borrowers who own 7-10 financed properties will continue to require a minimum 720 credit score.

- Reserves requirements have been enhanced. Required reserves will now be a percentage based on an aggregate of the unpaid principal balances (UPB) of the mortgage and/or HELOC on the other financed properties (not subject or primary residence). The percentage is determined by the number of additional financed properties the borrower owns as detailed below:

- 1-4 additional financed properties: 2% of the aggregate unpaid principal balance

- 5-6 additional financed properties: 4% of the aggregate unpaid principal balance

- 7-10 additional financed properties: 6% of the aggregate unpaid principal balance

- The definition of a financed property has been redefined to: A 1-4 unit property where the borrower is personally obligated on the mortgage (a property in the name of an LLC where the borrower has > 25% ownership is no longer counted)

- The maximum number of financed properties the borrower may own when purchasing a second home or investment property did not change; the maximum continues to be 10.

Determining the Number of Financed Properties

Included in the Property Count

The number of financed property is cumulative for all borrowers (jointly owned are only counted once). The count includes the actual number of properties that are financed (as defined below) not the number of mortgages on the property.

Included in the financed property determination:

- 1-4 unit residential properties where the borrower is personally obligated on the loan, and

- Includes the borrower’s primary residence if it is financed.

Not Included in the Property Count

The following are not included in the property count even when the borrower is personally obligated on the loan:

- Commercial real estate,

- Multifamily property consisting of 5 or more units,

- Timeshare property,

- Vacant lots (residential or commercial),

- Manufactured home on a leasehold estate that is not titled as real property, or

- Property owned in the name of an LLC regardless of the borrower’s ownership percentage in the LLC

Examples – Counting Financed Properties

- The borrower is personally obligated on mortgages securing 2 investment properties and the co-borrower is personally obligated on mortgages securing 3 other investment properties, and they are jointly obligated on their principal residence mortgage. The borrower is refinancing the mortgage on 1 of the 2 investment properties therefore the borrowers have 6 financed properties.

- The borrower is purchasing a second home and is personally obligated on their principal residence mortgage. Additionally, the borrower owns 4 two-unit investment properties that are financed in the name of a limited liability company (LLC) of which the borrower has a 50% ownership. Because the borrower is not personally obligated on the mortgages securing the investment properties, the investment properties are not included in the property count so consequently the borrower only has 2 financed properties.

- The borrower is purchasing and financing 2 investment properties simultaneously. The borrower does not have a mortgage lien against his or her principal residence but does have a financed second home and is personally obligated on the mortgage, 2 existing financed investment properties and is personally obligated on both mortgages, and a financed building lot. In this instance, the borrower will have 5 financed properties because the financed building lot is not included in the property count.

Calculating the Reserve Requirements for Additional Financed Properties

Not Included when Calculating Reserves

The following are not included when calculating the additional reserves required:

- The borrower’s primary residence,

- The subject property,

- Property that are sold or pending sale, or

- Accounts that will be paid by closing.

Included when Calculating Reserves

- Any financed property owned by the borrower (excluding the above) where the borrower is personally obligated on the mortgage.

Reserve Calculation for Additional Financed Properties

The applicable percentage (below) is applied to the aggregate outstanding UPB for all mortgages and/or HELOCS on the other financed properties:

- 1-4 additional financed properties: 2% of the aggregate unpaid principal balance

- 5–6 additional financed properties: 4% of the aggregate unpaid principal balance

- 7-10 additional financed properties: 6% of the aggregate unpaid principal balance

DU Reserve Requirement for Subject Property

The DU reserve requirement for the subject property remains unchanged and is a requirement independent of the required reserve calculation for the additional financed properties.

- Subject property is a second home: 2 months PITIA required reserves

- Subject property is an investment property: 6 months PITIA required reserves

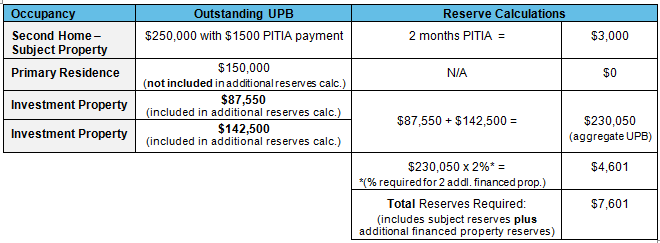

Example – Calculating Reserves for Additional Financed Properties

Borrower has a total of four financed properties (includes subject): Requires 2% of aggregate UPB on other financed properties required for additional reserve. DU will determine any additional reserves that may be required on the subject property.

These enhancements are eligible for new submissions and loans currently in the pipeline.

HomeBridge will update the Fannie Mae Conforming and High Balance matrix when DU 10.0 is released June 25, 2016. With the release of DU 10.0, DU will automatically determine the required reserves.

If you have any questions, please contact your Account Executive.