Homebridge is pleased to announce enhancements to the Simple Access program.

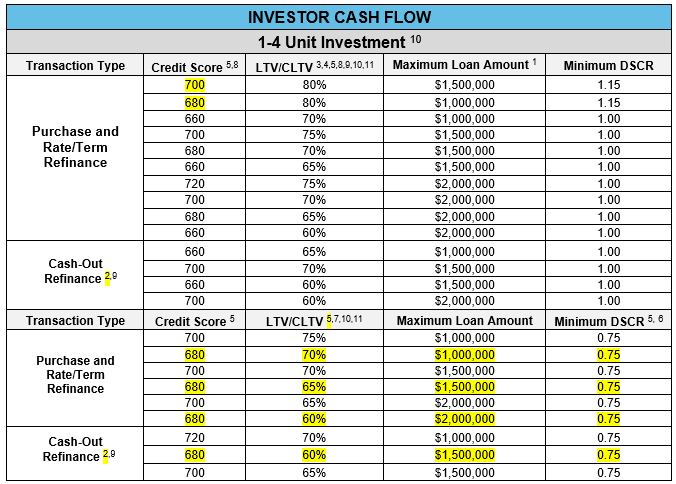

Investor Cash Flow Matrix Improvements (Updated matrix on pg. 2)

- Purchase and Rate/Term 80% LTV with $1,500,000 loan amount: Minimum 700 credit score (previously 720 and purchase transactions only)

- Purchase and Rate/Term 80% LTV with $1,000,000 loan amount: Minimum 680 credit score (previously minimum 720 credit score)

- Purchase and Rate/Term 70% LTV with 680 FICO and $1,000,000 loan amount with minimum 0.75 DSCR (new)

- Purchase and Rate/Term 65% LTV with 680 FICO and $1,500,000 loan amount with minimum 0.75 DSCR (new)

- Purchase and Rate/Term 60% LTV with 680 FICO and $2,000,000 loan amount with minimum 0.75 DSCR (new)

- Cash-Out 60% LTV with 680 FICO and $1,500,000 loan amount with minimum 0.75 DSCR (new)

Cash-out Improvement: Full Doc, Bank Statement, 1099 Only and P&L Only Options

- Cash-out transactions updated as follows:

- LTV ≤ 60%: Unlimited cash-out with no additional credit score overlay (previously 50% LTV, and cash-out > $300,000 required minimum 700 FICO)

- LTV > 60% Maximum cash-out $1,000,000 with no additional credit score or LTV requirement (previously 50% LTV and cash-out > $300,000 required minimum 700 FICO and > $500,000 max 60% LTV)

Cash-out Improvement: Investor Cash Flow Option

- Cash-out transactions updated as follows:

- LTV ≤ 60%: Unlimited cash-out (previously 50%)

- LTV > 60%: Maximum cash-out $500,000 with no additional FICO or LTV requirement (previously 50% LTV and cash-out > $300,000 required min 700 FICO)

- Investor Cash-Flow Foreign Nationals: Maximum cash-out remains at $500,000 but requirement for cash-out > $300,000 to have minimum 700 FICO removed

Non-Warrantable Condos: Full Doc, Bank Statement, 1099 Only, P&L Only Options

- The maximum LTV increased to 80% (previously 75%)

Profit and Loss Only Option

- The maximum LTV increased to 80% with no additional credit score overlay (previously 75% and minimum 700 FICO)

Bank Statement Option: Income Trend

- The acceptable variance level for deposit declines has been increased to 15% (previously 10%)

Bitcoin

- The 60 day seasoning requirement has been removed (does not apply to Asset Qualifier; if bitcoin used with Asset Qualifier option, 60 day seasoning requirement continues to apply)

- Evidence must be provided the funds have liquidated and deposited into a U.S. bank/financial institution prior to loan closing

Reminder: Homebridge management review and approval is required when bitcoin is being used for assets and bitcoin is the only eligible form of cryptocurrency

First Time Home Buyer (FTHB) Maximum Payment Shock

- The maximum payment shock for FTHBs has been increased to 300% (previously 250%)

Updated ICF Matrix

These improvements are effective immediately and may be applied to new submissions and loans currently in the pipeline.

The Simple Access guidelines have been updated and posted on the Homebridge website at www.HomebridgeWholesale.com

If you have any questions, please contact your Account Executive