Homebridge is introducing the new Investor Solution program which is designed specifically for second home and investment transactions.

This new product is being offered due to the recent restrictions placed on Fannie Mae and Freddie Mac by the Federal Housing Finance Agency (FHFA) that limits the amount of loans secured by second home and investment properties that Fannie Mae or Freddie Mac may purchase.

General Program Information

- All loans are run through DU or LPA and one of the following Findings is required

- A DU Approve/Eligible, or

- An LPA Accept/Eligible

- Topics not addressed in the Investor Solution guidelines Fannie Mae/Freddie Mac policies apply. The DU/LPA Findings are followed for any item not specifically addressed in the Investor Solution guides

- Loans must meet QM, Safe Harbor, and Ability to Repay requirements

Program Highlights

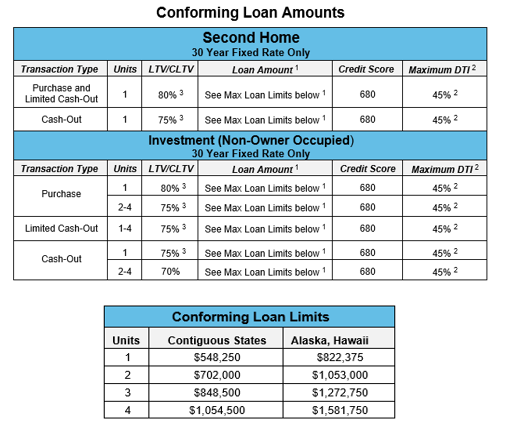

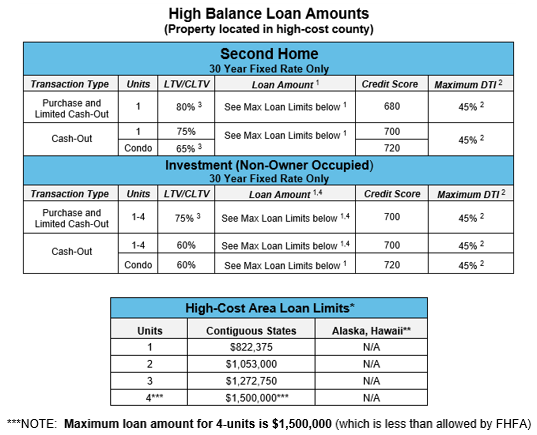

- LTV and FICO scores vary for conforming or high balance transactions (see matrices on page 2); all other guidance is the same for conforming and high balance transactions

- Max DTI 45%, no exceptions

- A full appraisal is required; appraisal waivers are not allowed

- 1-unit second home and 1-4 unit investment properties eligible; primary residence is not eligible

- Purchase, rate/term and cash-out eligible (Texas cash-out transactions are not eligible)

- Conforming Transactions: Minimum loan amount is $150,000

- High Balance Transactions:

- Minimum loan amount is $1 more than the applicable conforming loan amount for the number of units where the property is located for high balance transactions

- Maximum loan amount is the high-cost area loan limit for the area where the property is located with the following exception:

- 4-unit properties are limited to a maximum of $1,500,000 (FHFA allows up to $1,581,750 for 4-units in high-cost counties)

NOTE: Alaska and Hawaii currently do not have high-cost county designations, as such, conforming loan limits/FICO scores apply to properties in AK and HI

- SFR, PUD, condos (FNMA warrantable), and 2-4 units eligible

- Manufactured and modular/prefabricated ineligible

- 30 year fixed rate only

Investor Solution Program Matrices

The Investor Solution guidelines have been posted on the Homebridge website at www.HomebridgeWholesale.com

The Investor Solution program is available for new submissions on or after June 28, 2021

The Homebridge rate sheet will reflect Investor Solution pricing on June 28, 2021

If you have any questions, please contact your Account Executive