Ginnie Mae, the investor for FHA and VA transactions, issued APM 17-06 on December 7, 2017 which addresses new Ginnie Mae requirements for both FHA and VA cash-out refinance transactions and FHA Streamline and VA IRRRL credit and non-credit qualifying transactions. The new Ginnie Mae requirements do not apply to FHA rate/term credit qualifying transactions, including Simple Refinances.

Several of the new Ginnie Mae requirements are more restrictive than FHA and VA; as such, both FHA/VA and Ginnie Mae requirements will need to be met. A VA Quick Reference Chart is provided on page two and an FHA Quick Reference Chart is on page three.

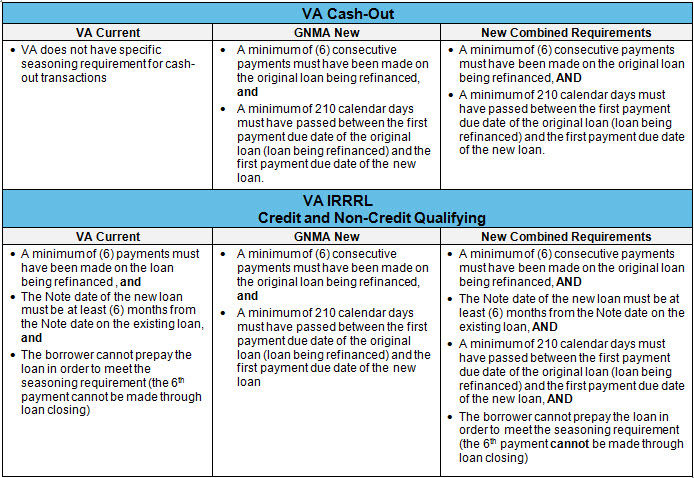

VA Cash-Out and IRRRL (Credit & Non-Credit Qualifying) Refinance Transactions

The following seasoning requirements apply:

- A minimum of six (6) consecutive payments must have been made on the original loan that is being refinanced as evidenced by the credit report or credit supplement (new for cash-out; current requirement for IRRRLs), and

- A minimum of 210 calendar days must have passed between the first payment due date of the original loan (loan being refinanced) and the first payment due date of the new loan (new for both cash-out and IRRRLs)

Reminder: The borrower cannot prepay the loan in order to meet the seasoning requirement and the 6th payment cannot be made through loan closing.

All other VA cash-out and IRRRL requirements must be met.

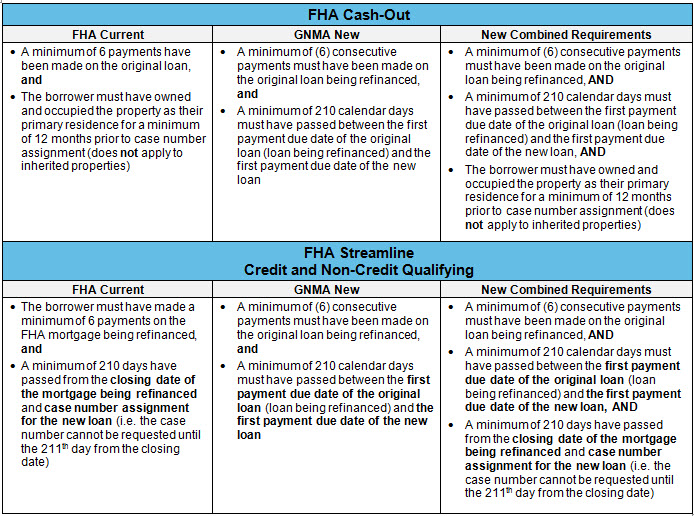

FHA Cash-Out and Streamline Refinance (Credit & Non-Credit Qualifying) Transactions

The following seasoning requirements apply:

- A minimum of six (6) consecutive payments must have been made on the original loan that is being refinanced as evidenced by the credit report or credit supplement (current requirement for cash-out and Streamlines), and

- A minimum of 210 calendar days must have passed between the first payment due date of the original loan (loan being refinanced) and the first payment due date of the new loan (new for cash-out and Streamlines).

Additionally, the following current FHA requirements continue to apply:

- FHA Streamlines: A minimum of 210 days must have passed from the closing date of the mortgage being refinanced and the case number assignment for the new loan (i.e. the case number cannot be requested until the 211th day from the loan being refinanced closing date)

NOTE: Both the new Ginnie Mae and current FHA 210 day requirement must be met.

- FHA Cash-Out: The borrower must own and occupy the property being refinanced as their primary residence for a minimum of 12 months prior to case number assignment (does not apply to inherited properties)

Reminder: The borrower cannot prepay the loan in order to meet the seasoning requirement and the 6th payment cannot be made through loan closing.

All other FHA cash-out and Streamline guidelines apply.

Transactions with 550-619 Credit Score

HomeBridge mortgage/housing history requirements for borrowers with a 550-619 credit score continue to apply.

Loans that do not meet the above seasoning requirements must fund no later than January 31, 2018.

The HomeBridge FHA and VA guidelines will be updated with this information and posted on the HomeBridge website at www.HomeBridgeWholesale.com in the near future.

If you have any questions, please contact your Account Executive.

VA Quick Reference Chart

Both VA’s current and GNMA’s new requirements (New Combined Requirements column below) must be met for loans funding February 1, 2018 and later.

FHA Quick Reference Chart

Both FHA’s current and GNMA’s new requirements (New Combined Requirements column below) must be met for loans funding February 1, 2018 and later.