Short-Term Rental Income Properties – Investor Cash Flow Transactions

The updates to the short-term rental guidance provide new options to qualify the DSCR.

Short-term rental income generated from properties using Airbnb, VRBO, HomeAway, etc. is eligible on ICF transactions subject to the following:

Purchase Transactions

- The subject property must be located in a short-term market area

- Minimum 1.25 DSCR required

- Minimum 700 credit score

- Maximum 75% LTV for borrowers with a minimum 1-year experience operating a short-term rental property

- Maximum 70% LTV for borrowers with < 1-year experience operating a short-term rental property

- Homebridge will obtain an AirDNA Rentalizer and Overview Report

- The Rentalizer and Overview Report must meet specific requirements; refer to the Debt Service Coverage Ratio (DSCR) – Determination of Rents topic in the Access guidelines for complete details

- The Rentalizer and Overview Report will be used to qualify the DSCR using the annual revenue divided by 12 months

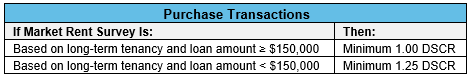

- In the event the AirDNA Rentalizer is not acceptable, a Market Rent Survey, completed by an appraiser is required and the following applies:

- An escrow/impound account is required (waiver not allowed)

Refinance Transactions

- Minimum 1.25 DSCR required (calculated based off 12 month documented pay history, including months with zero deposits)

- Maximum 70% LTV

- Minimum 700 credit score

- 12 months documented payment history from a third-party property manager required

- The short-term rental statement must clearly identify the subject property by address. Statements that only identify the property ID # and property description are not acceptable. If the payment history does not indicate the subject property address, a Market Rent Survey based on long-term tenancy can be used to qualify.

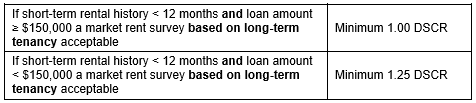

- If the rental history is < 12 months or if the property is self-managed, a Market Rent Survey based on long-term tenancy, completed by an appraiser and the following applies

- An escrow/impound account is required (waiver not allowed)

Short-Term Rental Purchase Transactions:

- Brokers are encouraged to provide any identifying information to assist the Underwriter in identifying the transaction as a short-term rental since this is not typically indicated on purchase contracts or MLS listings.

Short-term Rental Refinance Transactions:

- Brokers are encouraged to include a 12 month documented pay history from a third-party property management company at the time of submission in order for Underwriting to identify the transaction as a short-term rental.

New Submissions: Short-term rental updates apply to new submissions as of June 26, 2023.

Pipeline Transactions: The short-term rental update may be applied to existing pipeline refinance transactions but is not required if approved under previous guidance.

The Access guidelines have been updated with these changes and posted on the Homebridge website at www.HomebridgeWholesale.com

If you have any questions, please contact your Account Executive