HomeBridge is providing guidance on W-2/1099 forms for loans funding on or after February 1, 2019. The following policy applies to conventional, government, (including manually underwritten loans), Jumbo/Jumbo Flex, Expanded/Elite Plus, and Simple Access (when applicable).

W-2 and/or 1099 Forms

Federal law requires employers to issue Wage and Tax Statements (W-2) and Form1099-Misc for the previous year to employees/individuals no later than January 31st of the current year.

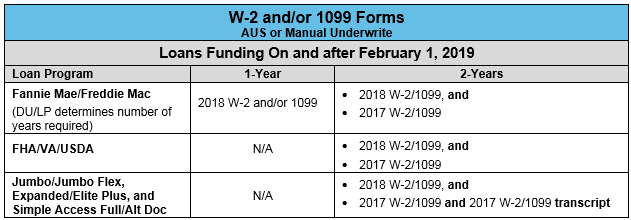

Loans Funding On or After February 1, 2019

When the AUS (DU/LP) Findings report or loan program requirements on manually underwritten loans require a W-2 and/or 1099 to support the income used to qualify the loan the following is required (as applicable):

In the event a borrower has not received their 2018 W-2/1099 form by January 31, 2019 HomeBridge will consider an exception on a case-by-case basis.

HomeBridge will order the transcripts for any transaction that requires transcripts or for transactions selected by HomeBridge for random transcript processing.

Loans Funding On or After April 1, 2019 and W-2/1099 Transcripts Required

Transcripts are generally not available until early April; any transaction that requires transcripts or, were selected for random processing, will require:

- The 2018 W-2/1099 transcript, OR

- 2018 “No Record Found