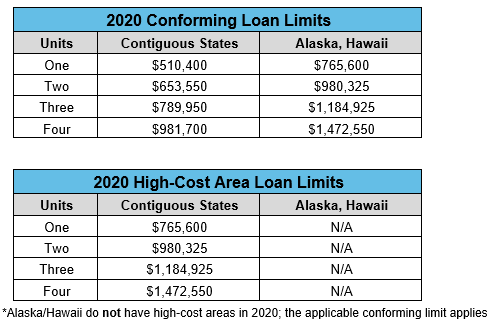

The Federal Housing Finance Agency (FHFA) has announced an increase to the maximum loan limits for both conforming and high balance/super conforming loan amounts for 2020 for most counties. The 43 counties that did not have an increase, the limits remain unchanged.

The loan limits below apply to Fannie Mae and Freddie Mac transactions.

The 2020 loan limits may be applied to new submissions and loans currently in the pipeline. Loans are eligible to close with the new 2020 limits.

Actual loan limits for certain high-cost counties may be lower than the amount indicated above. If the loan is a high balance/super conforming loan, it is important to check the loan limit for the specific county in which the property is located.

A complete list of counties, including high-cost area counties and their specific maximum loan limit, may be viewed at Federal Housing Finance Agency.

The FHFA did not identify high-cost limits for Alaska and Hawaii for 2020 therefore loan amounts for those states cannot exceed the applicable conforming loan limit.

Fannie Mae – DU Update

- Fannie Mae will be updating DU with the new 2020 loan limits the weekend of December 7, 2019

Freddie Mac – LPA Update

- Freddie Mac has not provided a specific date when LPA will be updated but have indicated it will be early December

Loans submitted to DU or LPA prior to the system updates that exceed the current 2019 limits will receive an “Approve/Ineligible