HomeBridge is pleased to announce enhancements to the Elite Plus program. Elite Plus will now include a 12 month bank statement option (Alt-Doc 12) in addition to the 24 month and an Alt-Doc Limited option that allows for 1-year tax returns.

Alt-Doc 12 is available for self-employed borrowers with 25% or more ownership interest in a business. The Alt-Doc Limited is available to salaried, wage earner and/or commissioned borrowers and self-employed borrowers with 25% or greater ownership in a business.

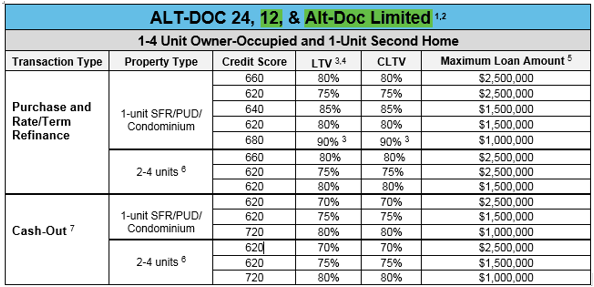

The Alt-Doc 12 and Alt-Doc Limited options have been added to the Alt-Doc 24 matrix (below)

NOTE: Alt-Doc 12 and Alt-Doc Limited: Maximum of 85% LTV/CLTV (90% LTV/CLTV does not apply)

Additionally, the following improvements have also been made to the Elite Plus matrices:

Alt-Doc Matrix:

- Condominiums no longer have separate credit score/LTV/CLTV criteria; the same criteria now applies to SFR/PUDs and condos

- The minimum credit score for $1,500,000 loan amount at 85% LTV/CLTV has been lowered to 640 (previously 660)

- The minimum credit score for $1,000,000 loan amount at 90% LTV/CLTV has been lowered to 680 (previously 720)

Full Doc Matrix

- The minimum credit score for a $1,500,000 loan amount at 90% LTV/CLTV has been lowered to 660 (previously 720) for a 1-unit SFR/PUD

- The minimum credit score for a $1,500,000 loan amount at 85% LTV/CLTV has been lowered to 620 (previously 660) for a 1-unit SFR/PUD

- The minimum credit score for a $1,000,000 loan amount at 85% LTV/CLTV has been lowered to 620 (previously 640) for a condominium

The Elite Plus guidelines and Submission form have been updated with this information and posted on the HomeBridge website at www.HomeBridgeWholesale.com. Additionally, the Expanded Plus/Elite Plus Comparison has also been updated

These updates are eligible with new submissions and loans currently in the pipeline.

If you have any questions, please contact your Account Executive