HomeBridge is pleased to announce enhancements to our Freddie Mac Home Possible and Freddie Mac programs. These enhancements align our guidelines with recent changes made by Freddie Mac in Freddie Mac Bulletin 2018-13 and Freddie Mac Bulletin 2018-16.

Home Possible

Home Possible Advantage has been consolidated into the Home Possible program. Along with this consolidation, Freddie Mac introduced several enhancements as noted below.

- Super conforming loan amounts are now eligible with ≤ 95% LTV. 01% to 97% LTV continues to be limited to conforming loan amounts.

- Non-occupant co-borrowers are now eligible on 1-unit properties. The maximum LTV is 95%. The non-occupant co-borrower’s income is included when determining if the property meets Freddie Mac income limit requirements (i.e. the combined qualifying income of the occupant borrower(s) and non-occupant co-borrower cannot exceed the applicable income limit where the property is located)

- Borrowers are now allowed to own other property without any restrictions (previously only allowed if the property was inherited, the mortgage was assigned to another party, or, if co-signed debt, it could be documented another party has made the payments for the most recent 12 months)

- 01% -97% CLTV/105% HCLTV will now allow standard subordinate financing to 97% including a HELOC. 97.01% -105% requires Affordable Second financing only and HELOCs ineligible.

- Rental income (aka boarder income) from the subject 1-unit property may now be received for only 9 months (previously 12 months required) but any amount received less than 12 months must be averaged for 12 months.

- Clarified that reserves, if required, are determined by LPA

The above enhancements are eligible for loans submitted or re-submitted to LPA on or after October 29, 2018.

Sweat equity, a credit for labor performed on the subject property and/or the materials purchased by the borrower, is now eligible as a source of funds to cover the funds needed for a down payment and/or closing costs. The credit for sweat equity must be fully explained and documented.

The following applies when using sweat equity:

- 1-Unit Primary Residence: Available up to program maximum of 97% LTV and may be combined with an Affordable Second up to a maximum 105% CLTV

- Manufactured Home and 2-4 Units: Maximum 95% LTV/CLTV

- All work must be completed in a skillful and workmanlike manner.

- An Appraisal Update and/or Completion Report (Freddie Mac Form 442) is required

- Sweat equity may be used as an eligible source of funds in connection with the following repairs and improvements:

- Repairs/improvements listed on the sales contract and included in the appraisal report that are to be completed by the borrower, and

- Repairs/improvements that are included on the appraisal report that are outstanding at the time of the appraisal.

NOTE: Credit for work completed prior to the original property inspection by the appraiser is not eligible for sweat equity

- The value of the sweat equity must be equal to:

- The value of the labor performed plus the value of the materials furnished documented as follows:

- Labor: The value of the labor performed must be estimated by the appraiser or a cost estimating service and documented in the appraisal report or in a separate document provided by cost estimating service, and

- Materials: The value of the materials must be estimated/calculated as follows:

- The appraiser must estimate material costs, or

- A cost estimating service must estimate material costs, or

- Calculate using receipts from the purchase of the materials, and

- The documentation of how estimated/calculated must be included in the loan file

- The value of the labor performed plus the value of the materials furnished documented as follows:

- Cash-back to the borrower is not allowed on transactions involving sweat equity; any excess funds must be applied as a principal reduction

The above sweat equity enhancement is available for new submissions and loans currently in the pipeline, with an application date on or after September 26, 2018.

Freddie Mac Conforming and Super Conforming Program

Student Loans

Currently, student loan payment calculations are based on the payment type. With this update Freddie Mac has simplified student loan calculation requirements; now loans in repayment, deferred, or in forbearance are calculated the same.

Loans in repayment, deferred, or in forbearance calculate payment to be included in DTI as follows:

- Payment Amount greater than Zero: If the monthly payment amount is greater than zero, use the monthly payment amount reported on the credit report or other documentation provided, OR

- Payment Amount Zero: If the monthly amount reported on the credit report is zero, use 0.5% of the outstanding loan balance on the credit report

There was no change to Freddie Mac policy for student loans in these categories; forgiveness, cancellation, discharge, or employment-contingent.

Cash Back to the Borrower on Rate/Term Refinance Transactions

The maximum cash back allowed on rate/term transaction has been updated to the following:

- Cash back to the borrower is allowed up to the greater of:

- 1% of the loan amount, or

- $2,000

Previously cash back was the lesser of 2% of the new mortgage amount or $2,000.

Properties Subject to Resale/Deed Restrictions – Restriction Terminates with Foreclosure

Freddie Mac updated their requirements for properties subject to resale restrictions when the restriction terminates upon foreclosure, at the end of any foreclosure redemption period (if applicable), or at the time a deed-in-lieu of foreclosure is recorded the following applies:

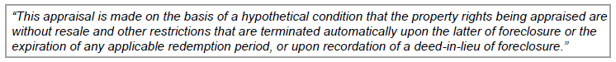

- The seller of the property must ensure the borrower and the appraiser are aware of the resale restriction. The appraiser must include the statement below in the appraisal report:

- The appraisal must reflect the market value of the property without the resale restriction

- The requirement for the appraiser to provide two comparable sales with similar resale restrictions no longer applies. The appraiser is only required to state the existence of the resale restriction and note any impact the restriction may have on the property’s value and marketability

- The applicable LTV/CLTV/HCLTV is determined using the appraised value

The above changes to student loans, cash back, and properties subject to resale restrictions may be applied to new submissions or loans currently in the pipeline.

Additional updates will follow as Freddie Mac changes become effective.

The HomeBridge Freddie Mac Conforming and Super Conforming guidelines, the Home Possible guidelines have been updated with this information and posted on the HomeBridge website at www.HomeBridgeWholesale.com

If you have any questions, please contact your Account Executive.