Homebridge is pleased to announce an updated locking process for eligible FNMA and FHLMC purchase transactions with LLPA waivers associated with AMI requirements.

FNMA and FHLMC purchase transactions locked Monday, April 3, 2023 and later will now offer the Broker the option to lock with or without the first time home buyer (FTHB) LLPA adjustments. Additionally, a new Duty to Serve indicator has been added to P.A.T.H.

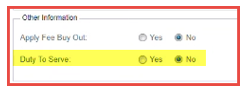

New Duty to Serve Indicator in P.A.T.H.

A new indicator has been added to the Short Application in the Other Information section that will reflect on all loan programs. The new indicator is not limited to FNMA and FHLMC purchase transactions.

P.A.T.H. will default the indicator to “No” for the Duty to Serve indicator. The indicator does not impact pricing.

No action is required from the Broker on the Duty to Serve indicator.

P.A.T.H. Changes: FNMA/FHLMC Purchase Transactions Locking On and After Monday, April 3, 2023

Brokers can now request that a FNMA/FHLMC purchase transaction be locked either with or without the FTHB LLPA waiver adjustments. It is important to note that the requested lock option is subject to Homebridge Underwriter validation of eligibility of Area Median Income.

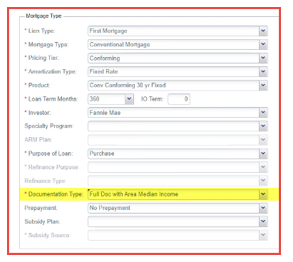

If the Broker opts to lock with the FTHB LLPA pricing adjustment waiver applied the Broker must change the Documentation Type within the Mortgage Type section in the Short Application to Full Doc with Area Median Income.

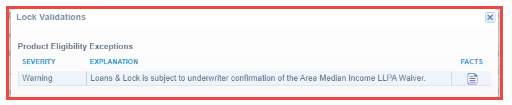

When locking using Full Doc with Area Median Income, the Broker will receive a warning message that the lock is subject to the Homebridge underwriter validation of eligibility for Area Median Income:

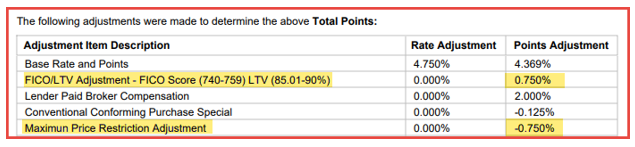

The Lock Confirmation will reflect any LLPA adjustments to pricing as well as a Maximum Price Restriction Adjustment. The Maximum Price Restriction Adjustment will reflect as a credit which offsets any LLPA adjustments to pricing.

In the event the Homebridge Underwriter validates that income does not meet AMI requirements, the Underwriter will update the Doc Type to Full Doc. The loan will be repriced and an updated Lock Confirmation will be generated removing the Maximum Price Restriction Adjustment “credit”.

If you have any questions, please contact your Account Executive