Fannie Mae updated DU 10.3 the weekend of December 7, 2019 to align DU with changes announced by Fannie Mae in Announcement 2019-08 issued October 2, 2019. The updates apply to loan casefiles submitted/resubmitted to DU on or after the weekend of December 7, 2019 unless noted below.

Homeownership Education Requirements

Fannie Mae is adding additional transactions that require a borrower complete homebuyer education. At least one borrower must now complete homebuyer education on the following:

- Purchase transaction with an LTV/CLTV greater than 95% AND all borrowers are first-time homebuyers

- HomeReady purchase transactions when ALL occupying borrowers are first-time homebuyers, regardless of the LTV

Additionally, Fannie Mae will no longer charge borrowers the $75 fee for taking Fannie Mae’s online Framework® Homeownership, LLC course.

Rental Income Used for Qualifying

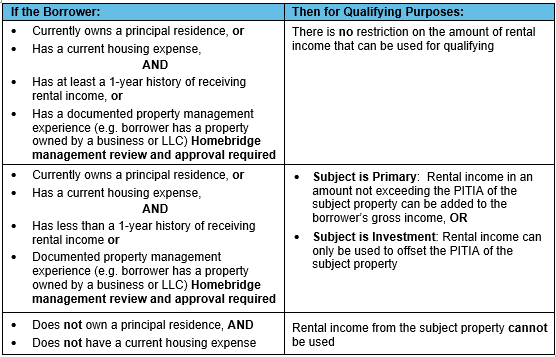

Fannie Mae has updated their policy regarding when rental income from a 1-4 unit investment or 2-4 unit primary residence can be used for qualifying. The amount of rental income from the subject property that may be used for qualifying is determined as outlined below:

NOTE: Homebridge policy for FTHB purchasing an investment property and the property is located in one of the five boroughs of New York City or certain CA counties continues to apply.

Documentation of property management experience is required as follows:

- The borrower’s most recent signed federal income tax return, including Schedules 1 and E. Schedule E should reflect rental income received for any property and Fair Rental Days of 365, or

- If the property has been owned for at least one year, but there are less than 365 Fair Rental Days on Schedule E, a current signed lease agreement may be used to supplement the federal income tax return, or

- A current signed lease may be used to supplement a federal income tax return if the property was out of service for any time period in the prior year. Schedule E must support this by reflecting a reduced number of days in use and related repair costs. Form 1007 or 1025 must support the income reflected on the lease

Alimony

Fannie Mae allows alimony to be deducted from the borrower’s monthly qualifying income or the payment may be included in the borrower’s DTI calculation. Fannie Mae clarified if reducing the borrower’s monthly income by the amount of alimony paid, the alimony obligation is entered in DU as a negative amount under “Income Type