Homebridge is updating our HELOC program to add additional credit score and CLTV options with lower margins than currently available. Additionally, the maximum back-end DTI is being lowered for borrowers with a credit score less than 720 and there have been multiple credit inquiries in the previous 6 months.

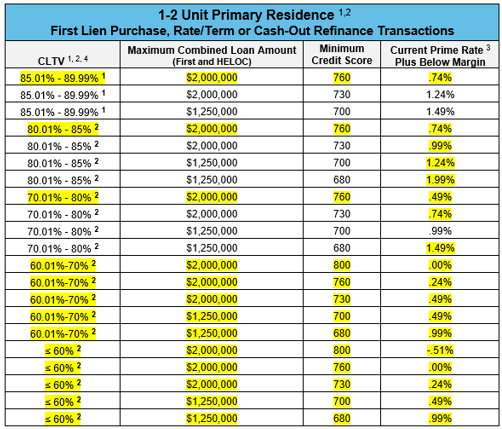

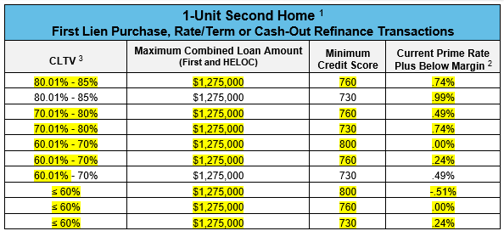

Updates/additions are highlighted on the matrices below.

DTI Update

The maximum back-end DTI is 38% when the borrower has a credit score of < 720 and the credit report indicates 5 or more credit inquiries in the previous 6 months (currently the back-end DTI is 45% with no restrictions)

General HELOC Reminders

- HELOCs are available with a Fannie Mae or Freddie Mac first lien only; this is not a stand-alone HELOC product

- The maximum HELOC amount for 1-2 unit primary residence transactions is determined by the CLTV:

- 01% to 89.99% CLTV: Maximum HELOC amount is $350,000

- 85% CLTV and below: Maximum HELOC amount is $500,000

- The maximum HELOC amount for a 1-unit second home transaction is $250,000

The HELOC program guidelines have been updated and posted on the Homebridge website at www.hombridgewholesale.com

These updates are effective immediately and apply to new submissions and loans currently in the pipeline.

If you have any questions, please contact your Account Executive