Homebridge is pleased to be adding a temporary buydown option to Simple Access. Additionally, we are making an enhancement to gift fund eligibility and addressing requirements for properties located in a declining market

Temporary Buydown Eligibility

- Eligible on Full Doc, Bank Statement, and 1099 Only documentation options only

- Fixed rate purchase transactions only; ARMs ineligible

- 1-4 unit primary residence and 1-unit second home transactions

- Seller funded buydowns only

- Available buydowns:

- 1/0,

- 2/1

- Maximum 80% LTV

- Maximum loan amount $2,000,000

- Minimum loan amount $150,000

- A 0x30 in the previous 12 months mortgage/rental history required

- Temporary buydown ineligible on the following:

- Investment properties

- Transactions using the interest-only feature

- Transactions with a non-occupant co-borrower

Temporary Buydown Reminders

- A temporary buydown lowers the borrowers monthly mortgage payment for a limited period of time through a temporary buydown on the initial interest rate (aka rate reduction subsidy)

- Buydowns are qualified at the Note rate, not the initial buydown rate

- When submitting a loan with a temporary buydown feature the following is required:

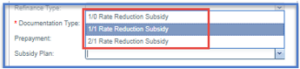

- On the Short Application page in P.A.T.H. go to the Mortgage Type section and select the applicable buydown type from the Document Type dropdown menu:

- 1/0 Buydown

- Select: 1/0 Rate Reduction Subsidy

- 2/1 Buydown

- Select: 2/1 Rate Reduction Subsidy

- 1/0 Buydown

- On the Short Application page in P.A.T.H. go to the Mortgage Type section and select the applicable buydown type from the Document Type dropdown menu:

- There are unique requirements for the LE and CD

- The Buydown Agreement is provided with the closing documents and must be signed by the borrowers

Gift Funds

Gift funds are now eligible on investment property purchase transactions subject to the following:

- LTV > 75%: Gift funds allowed after a 5% borrower contribution

- LTV ≤ 75%: Gift funds eligible; a borrower contribution is not required

NOTE: Gift funds continue to be ineligible for foreign national borrowers

Second home gift fund eligibility is being updated as follows:

- A borrower contribution is no longer required on a second home purchase transaction utilizing gift funds if the LTV is ≤ 75%.

- If the LTV is > 75% gift funds continue to be eligible after a 5% borrower contribution

Properties Located in a Declining Market

If the appraisal indicates the property is in a declining market, a 5% LTV reduction is required

Effective Dates

- The buydown feature is available for new submissions and pipeline transactions (pipeline transactions require an applicable COC) on or after January 13, 2023

- The gift funds and declining market updates apply to loans locked on or after January 13, 2023

The Simple Access guidelines have been updated and posted on the Homebridge website at www.HomebridgeWholesale.com

If you have any questions, please contact your Account Executive