Homebridge is pleased to introduce the Freddie Mac Refi Possible program. Refi Possible is a refinance option designed for low-income borrowers that offers expanded eligibility to benefit borrowers who are at or below 80% of the area median income (AMI) limit.

Refi Possible Overview

- The loan being refinanced must currently be owned by Freddie Mac

- The borrower’s qualifying income (income from all borrowers who will sign the Note) must be ≤ 80% of the AMI limit where the property is located.

NOTE: If borrower has other income not used for qualifying, that income is not included when determining if AMI requirement has been met

- LPA will determine income eligibility. The AMI for a specific area may also be looked up using Freddie Mac’s Home Possible Income & Property Eligibility Tool

- The refinanced loan must provide the following borrower benefits:

- A reduction in the interest rate of at least 50 basis points, AND

- LTV ≤ 80%: There is a reduction in the borrower’s monthly principal and interest payment by a minimum of $50, OR

- LTV > 80%: There is a reduction in the borrower’s monthly principal, interest, and mortgage insurance payment by a minimum of $50

- All borrowers on the loan being refinanced must be on the new loan; borrowers cannot be added to the new loan or deleted from the existing loan except as noted below (exception is for deleting a borrower only; borrowers cannot be added)

- One or more borrower(s) may be deleted only if one of the following applies:

- The remaining borrower(s) can provide evidence that they have made the mortgage payments from their own funds from the previous 12 months, including any secondary financing, OR

- The borrower being removed is deceased and evidence documenting the borrower’s death is provided (e.g. death certificate) and it is documented in the loan file

- In all cases, at least one borrower on the current loan must be on the new loan

- LPA determines appraisal requirement; ACE offers (appraisal waiver) are eligible if offered by LPA

- If an appraisal is required, Freddie Mac will provide a $500 credit that must be passed on to the borrower

- A maximum of $5,000 in closing costs may be included in the new loan amount

- Refi Possible is eligible for one time use

- All borrowers on the loan being refinanced must be on the new loan; borrowers cannot be added to the new loan or deleted from the existing loan except as noted below (exception is for deleting a borrower only; borrowers cannot be added)

Refi Possible Eligibility

- All standard Freddie Mac requirements apply, including any applicable temporary policies in place due to COVID-19, unless indicated below

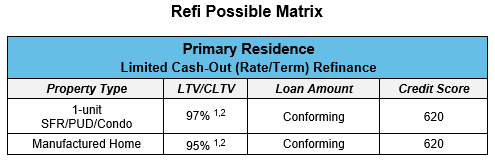

- Conforming loan amounts only; super conforming ineligible

- 1-unit primary residence only

- SFR, PUD, condo (warrantable) or manufactured homes eligible

- Minimum 620 score

- Maximum 65% DTI

- Maximum LTV/CLTV:

- SFR, PUD, Condo: Maximum 97%

- Manufactured home: Maximum 95% LTV/CLTV

- Transactions where there is a non-occupant co-borrower: Maximum 95% LTV/CLTV

- CLTV up to 105% allowed when a Community Second is being resubordinated

- Payment history on the existing loan requires:

- 0x30 in the most recent 6 months, and

- No more than 1×30 in months 7-12, and

- 0x60 in the most recent 12 months

NOTE: If the borrower was in forbearance due to COVID-19 and had missed payments, and those missed payments have been resolved per Freddie Mac’s standard forbearance plan policy, the missed payments are not considered delinquencies when determining if the above payment history requirements have been met. Refer to the Mortgage/Rental History topic in the Homebridge Freddie Mac Conforming and Super Conforming guidelines posted on the Homebridge website for forbearance plan requirements

- Standard mortgage insurance requirements apply

- Maximum $250 cash-back to the borrower; any excess funds must be applied as a principal reduction

- Fixed rate only with a 30 year loan term

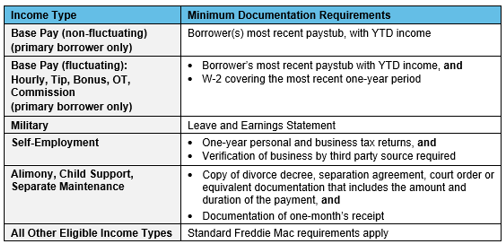

- Income documentation requirements are detailed below:

Subordinate financing:

- Existing subordinate financing:

- Cannot be paid off with proceeds from the new loan,

- May remain in place if resubordinated to the new loan,

- May be simultaneously refinanced with the existing first lien provided:

- The unpaid principal balance (UPB) of the new subordinate lien is not more than the UPB of the subordinate lien being refinanced at the time of payoff, and

- There is no increase in the monthly principal and interest payment on the subordinate lien

- New subordinate financing permitted only if replacing existing subordinate financing

- Funds to close must be verified as follows:

- Funds to Close > $500: Verification of funds to close is required

- Acceptable documentation includes one recent account statement showing asset balance (monthly, quarterly, or annual statement, as applicable)

- Funds to Close ≤ $500: Verification of funds to close are not required

- Funds to Close > $500: Verification of funds to close is required

The Refi Possible guidelines have been posted on our website at www.HomebridgeWholesale.com on the Products and Guidelines page

Refi Possible is available for new submissions effective August 30, 2021

The Homebridge rate sheet will reflect Refi Possible pricing on August 30, 2021

The Freddie Mac Loan Look-Up Tool website may be used to determine if Freddie Mac owns a loan

If you have any questions, please contact your Account Executive