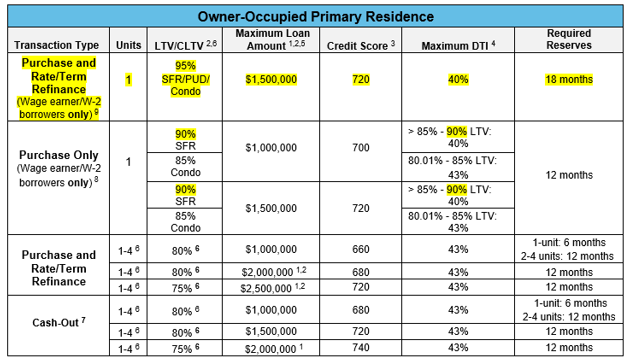

Homebridge is making an enhancement to the maximum LTV/CLTV on the Jumbo program to increase it to 95%.

90.01% to 95% LTV/CLTV

The following applies to transactions with an LTV of 90.01% to 95%:

- 1-unit primary residence only

- SFR, PUD, and condos eligible

- Purchase and rate/term refinance transactions eligible

- All borrowers must be W-2/wage earner or salaried borrowers; self-employed borrowers ineligible

- Maximum loan amount $1,500,000

- Minimum credit score 720

- 18 months PITIA reserves required plus additional 6 months PITIA for each additional financed property owned by the borrower (based on financed properties PITIA payment)

- Maximum DTI 40%, no exceptions

- Mortgage history:

- 0x30 in previous 6 months, and

- 1×30 in previous 24 months

- Tradelines:

- Three (3) tradelines from traditional sources reporting for a minimum of 24 months, and

- One (1) tradeline must be open and active for the most recent 12 months

- Derogatory credit:

- Bankruptcy (7,11,13), Foreclosure, and Deed-in-Lieu: 7 year waiting period measured from discharge/dismissal/disbursement date, as applicable

- Short Sale, Pre-Foreclosure, and Loan Modification: 4 year waiting period measured from completion/sale/modification date, as applicable

- Appraisal:

- Loan amounts ≤ $1,000,000: One (1) full appraisal

- A CDA is required. If the CDA indicates the value is “Indeterminate” or the tolerance is > 10% a field review or second appraisal will be required; the lower of the values will be used

- Loan amounts ≤ $1,000,000: One (1) full appraisal

- Loan amounts > $1,000,000 to $1,500,000: Two (2) full appraisals

- A CDA is required for each appraisal. If the CDA indicates the value is “Indeterminate” or the tolerance is > 10% a field review or an additional full appraisal will be required; the lower of the values will be used

- First time homebuyers and non-permanent resident alien borrowers are ineligible

- CEMA and construction-to-perm transactions ineligible

The current maximum LTV (for purchase transactions with a W-2/wage earner borrowers) has been raised to 90% from 89.99%.

Updated Jumbo Owner-Occupied Matrix

The Homebridge Jumbo/Jumbo AUS guidelines have been updated and posted on the Homebridge website at www.HomebridgeWholesale.com

This increased LTV enhancement is available for new submissions and loans currently in the pipeline on or after November 12, 2021

If you have any questions, please contact your Account Executive.