Homebridge is pleased to offer a new P&L Only documentation option on our Simple Access program.

The P&L Only option has been added to the existing Alt Doc matrix and has the same Loan Amount/DTI requirements as the Bank Statement and 1099 Only options however, the P&L Only option will require a minimum 700 credit score and the maximum LTV is limited to 75%.

Highlights of the P&L Only option are as follows:

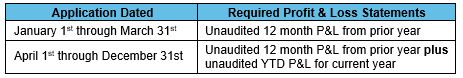

- The most recent unaudited P&L(s) are provided subject to the following:

- Eligible for self-employed borrowers with a minimum of 2-years self-employment and ≥ 50% ownership of the business

NOTE: Ownership interest is cumulative for all borrowers (i.e. if borrower 1 has 25% ownership and borrower 2 has 25% ownership the ≥ 50% ownership requirement has been met)

- Purchase, rate/term and cash-out primary residence, second home, and investment transactions

- Fixed rate and 7/6 or 10/6 ARMs and the interest-only feature eligible

- Qualifying income is the lower of:

- The income based on the unaudited P&L(s), OR

- The monthly income disclosed on the initial, signed 1003

- The net income is calculated from the P&L(s) based on the borrower(s) percentage of ownership (e.g. if the borrower(s) have 65% ownership interest, the qualifying income is the net income calculated using the P&L(s) multiplied by 65%)

- Minimum $2,500 residual income required on primary residence transactions only

- P&L(s) must be prepared by an independent entity. Borrower prepared P&Ls are not eligible. Acceptable entities include:

- A Certified Public Accountant (CPA), or

- IRS Enrolled Agent (EA), or

- Tax preparer registered with the California Tax Education Council (CTEC)

- The P&L(s) must be signed by both the borrower(s) with an ownership interest AND the preparer (non-owner borrowers are not required to sign)

- Documentation Requirements:

- A business license, letter from a tax preparer or Secretary of State filing is required to verify the business has been in existence for a minimum of 2 years

- ≥ 50% ownership percentage must be documented by a CPA, EA, CTEC letter, or Operating Agreement

- The CPA, EA or CTEC registered tax preparer must confirm, in writing, one of the following:

- They have reviewed and prepared the P&L using working financial papers and that the P&L accurately reflects the business cash flow and expenses. The CPA/EA/CTEC registered tax preparer must also confirm that they have prepared the most recent year of business tax returns, OR

- They prepared the prior two years of tax returns for the borrower’s business, they prepared the P&L(s), and the P&Ls accurately reflect the business cash flow and expenses

- A copy of the CPA or CTEC active license is required. If P&L prepared by an EA, a screen shot from the IRS EA website, validating the enrolled agent credentials, is required

- A letter detailing the nature of the business, signed and dated by the borrower, is required

- Two (2) months most recent business bank statements required and the bank statements must support the gross receipts/sales reflected on the P&L

- The average deposits on the bank statements must be greater than the average monthly sales OR no less than 10% below the average monthly sales. If not, additional bank statement(s) required

- If the average deposits are more than 10% below the average monthly sales, additional bank statements i.e. the next most recent statement(s) may be added to the analysis until the tolerance is acceptable

Example:

- Acceptable Tolerance: Average deposits that are 10% below (i.e. 10%, 9%, 8%, etc.) the average monthly sales do not require the additional most recent bank statement

- Unacceptable Tolerance: Average deposits that are 10.01% or more (i.e. 10.01%, 11%, 12%, etc.) below the average monthly sales will require the next most recent statement(s) until the tolerance is acceptable

A new P&L Only Documentation Eligibility and Summary section has been added to the Simple Access guidelines; refer to the guidelines for complete P&L Only requirements. Topics not addressed in the P&L Only section, standard Simple Access policy applies.

The updated Simple Access guidelines have been posted on the Homebridge website at www.HomebridgeWholesale.com

The new P&L Only option is available for new submissions on and after October 14, 2022

If you have any questions, please contact your Account Executive.