The Internal Revenue Service (IRS) is replacing the current 4506-T with the 4506-C Income Verification Express Service (IVES) Request for Transcript of Tax Return form to better protect taxpayer’s personal information

Beginning March 1, 2021 the IRS will only accept the new 4506-C form dated September 2020 for transcript requests.

4506-C Form

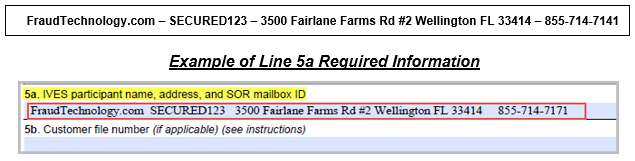

The new 4506-C form requires Line 5a be completed when transcripts are delivered to a third party. The information entered on Line 5a allows the transcripts to be delivered to a secure mailbox.

The Homebridge IVES participant information must be included on Line 5a, in its entirety, as shown below or the transcript request cannot be processed.

The new 4506-C form, with Line 5a prefilled with the required information, has been posted on the Homebridge website Forms page under General Forms. If personal and business returns are used for qualifying a separate, fully completed and executed 4506-C form is required

When required by loan program, the initial 4506-C must be included with the loan submission. Best practices for Brokered and NDC/EB submissions, to avoid processing delays in the event Homebridge requires the processed transcript, are detailed below.

Brokered Transactions: Submitting the Signed/Completed 4506-C

- Homebridge Disclosed Transactions: 4506-C not required (currently not available for USDA or renovation transactions)

- Broker Disclosed Transactions: Two Options Available

- Provide the completed and signed 4506-C with Homebridge specific IVES information on Line 5a at time of loan submission, OR

- During the loan process, provide Homebridge the signed copy from Homebridge’s initial lender disclosures (preferred method)

NDC/EB Transactions: Submitting the Signed/Completed 4506-C

NDC/EB transactions require a signed/completed 4506-C at loan submission on applicable transactions.

- The submitted 4506-C must reflect the Homebridge specific IVES information on Line 5a

4506-C Quick Reference Guides

Homebridge has created a 4506-C Quick Reference Guide Individual Taxpayer and a 4506-C Quick Reference Guide Business Returns to provide guidance for completing the 4506-C. These QRGs can be found under “Reference Guides – General