Homebridge has made updates and clarifications to our Simple Access guidelines.

Matrices

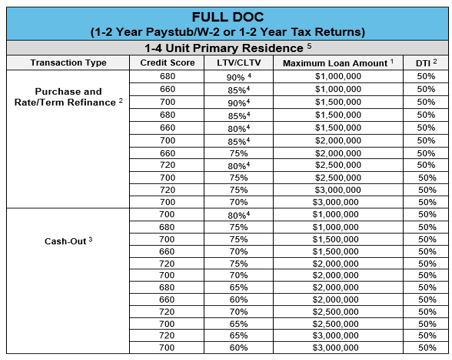

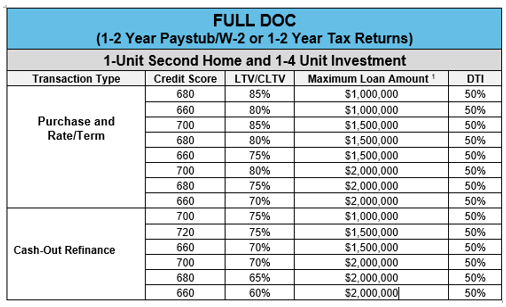

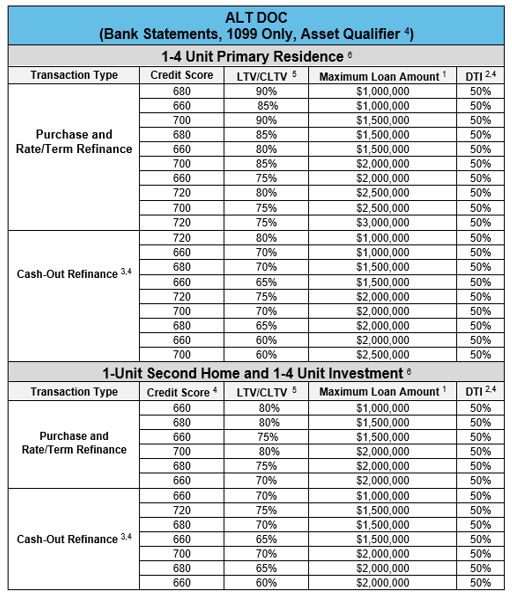

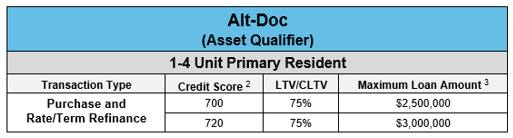

The Simple Access matrices have been updated to separate matrices by documentation option

- Full Doc: Includes 1 or 2 Year Paystub/W-2 or 1 or 2 Year Tax Returns

- Alt Doc: Includes 12 or 24 Month Bank Statement, 1099 Only, and Asset Qualifier

NOTE: Asset Qualifier has separate LTV/Loan Amount/Credit Score matrix

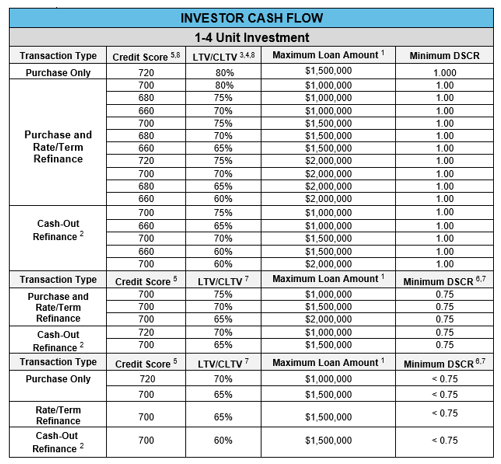

- Investor Cash Flow

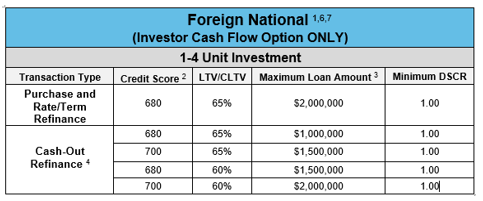

- Foreign National

The updated matrices are included beginning on page 3 of this Bulletin

Highlights of the updates are below; refer to the Simple Access guidelines for complete details

Alt Doc Bank Statement Option Specific Updates/Clarifications

- Updated 12 and 24 months bank statements income trend policy for declining income

- Rental Income – Subject Property Purchase: Gross rental income is the market rent as determined by the appraiser

Investor Cash Flow Specific Updates/Clarifications

- When the LTV is ≤ 70% and ≥ 700 credit score the additional PITIA reserves has been lowered to 3 months

- Maximum cash-out is $500,000 regardless of LTV

- The interest-only feature is now eligible on an ARM transactions with a 40 year loan term amortized over 30 years in addition to the 30 year loan term amortized over 20 years

- DSCR requirements are now determined by LTV/loan amount/credit score and the minimum DSCR is now listed on the ICF matrix; refer to the ICF matrix for requirements

- Updated foreign national eligibility

Full Doc Updates/Clarifications

- Derogatory credit event exception allowing for a 0-2 year waiting period from event end date to event completion date has been removed; the minimum waiting period is now 2 years, subject to a maximum 75% LTV or the maximum allowed per the matrix for the transaction type, whichever is less

- Loan amounts up to $3,000,000 now available on Full and Alt Doc options

- Minimum credit score is now 660

- Maximum DTI 50%

- Cash-out transactions are subject to the following:

-

- A 12 month lookback required (measured from Note date to Note date) for ALL mortgages the borrower(s) are obligated on to determine if any cash-back was received

- Any cash received by the borrower(s) in the previous 12 months must be applied to the maximum cash-out limitations (i.e. the borrower is limited to a maximum of $1,000,000 cash-out proceeds from all transactions/properties over the previous 12 months)

- The requirement is cumulative for all borrowers on the transaction

Example:

-

- Cash-out limit is $1,000,000

- If one borrower had a cash-out refinance (subject or non-subject) and received 400,000 in cash within the previous 12 months, and

- Another borrower had a cash-out refinance on a different property and received $200,000 in cash within the previous 12 months

- The cash-back on the subject property transaction is capped at $400,000 (subject to the cash-back LTV/credit score criteria as applicable)

- Additionally, cash-back limitations also include the amount of cash-in-hand to the borrower PLUS the payoff of any non-mortgage debt

Example:

-

- Cash-out limit is $500,000

- Borrower is paying off $200,000 in non-mortgage debt

- Maximum cash-in-hand to borrower is $300,000

- Full and Alt Doc Options: Maximum cash-out:

- Maximum cash-out $1,000,000

- Cash-out > $300,000 requires a minimum 700 credit score, and

- Cash-out > $500,000 maximum 60% LTV

- Reserve requirements have been updated

- The interest-only feature is available for primary residence and second home transactions ONLY; IO feature is no longer available for investment transactions EXCEPT as noted below:

- Investor Cash Flow option interest-only option continues to be eligible

- Appraisal requirements have been updated as follows:

- ≤ $1,500,000 requires one full appraisal

- > $1,500,000 requires two full appraisals

- Bitcoin is now an eligible source of assets for funds to close subject to Homebridge management review and approval. Bitcoin is ineligible to satisfy reserve requirements

- Updated residual income requirements for Full Doc, Bank Statement, 1099 Only and Asset Qualifier

- Clarified that Homebridge will provide financing for a maximum of 5% of the total units in a condo project (warrantable and non-warrantable projects), and updates made to non-warrantable condos

- A 1×30 in the previous 12 months housing history is now eligible

- Vesting in the name of a corporation or partnership is no longer eligible

- Updated LLC requirements to add the following:

- LLCs are eligible on investment properties only

- The LLC must have been created to manage rental properties only

- A maximum of two (2) members in the LLC and must be a U.S. citizen or permanent resident alien

- All members of the LLC must be borrowers on the transaction

- Clarified that New York CEMA transactions are not eligible

- The property/hazard insurance coverage requirements have been updated as detailed below

- Property/hazard insurance coverage for SFRs must, at minimum, be equal to:

- Replacement cost coverage (or similar verbiage) as stated on the Declarations page, OR

- 100% of the insurable value of improvements as established by the insurer or as determined from the appraisal

NOTE: The option to calculate coverage using 80% of the insurable value/cost estimate is no longer eligible

- The Insurance Quick Reference Guide, Standard Coverage Requirements topic, has been updated to reflect the new property/hazard insurance requirements

Updated Matrices

Effective Dates

- Transactions Underwritten and Approved on or before May 2, 2022

- Eligible under the current Simple Access guidelines

- Previously approved exceptions will be honored as long as there are no changes to the approved exception

- The loan must close by the rate lock expiration date

- Transactions Underwritten and Approved on or after May 3, 2022

The loan is subject to the new credit requirements detailed in this communication

- Updated Insurance Requirements

The updated insurance requirements will go into effect for transactions that are CTC May 16, 2022 and after

Guidelines

Simple Access guidelines are posted on the Homebridge website at www.HomebridgeWholesale.com on the Products and Guidelines page

- The current Simple Access guidelines will remain posted on the website as “Simple Access – Transactions Approved on or before May 2, 2022”

- The updated Simple Access guidelines will be posted on the website as “Simple Access – Transactions Approved May 3, 2022 and After”

Insurance Quick Reference Guide

- The current Insurance QRG will remain posted on the website on the Working With Us page under Reference Guides – General on the website as “Insurance Quick Reference Guide for Transactions CTC on or before May 15, 2022”

- The updated Insurance QRG has been posted on the website on the Working With Us page under Reference Guides – General on the website as “Insurance Quick Reference Guide for Transactions CTC May 16, 2022 and After”

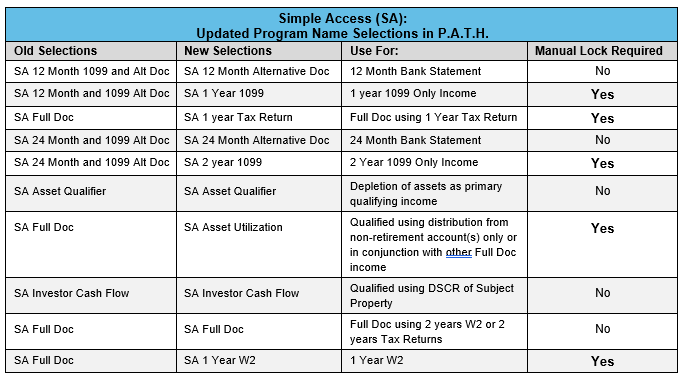

Updates to P.A.T.H.

The program selections in P.A.T.H. have been updated as detailed in the chart below. Additionally, certain selections will require a manual lock as noted in the chart.

If you have any questions, please contact your Account Executive