Homebridge is now offering temporary buydowns on Fannie Mae, Freddie Mac, FHA, and VA transactions. Buydowns make the first year(s) of the borrower’s mortgage payment more affordable allowing the borrower to have additional cash for home improvements, landscaping, the purchase of furniture etc.

Temporary Buydown Overview

- A temporary buydown lowers the borrowers monthly mortgage payment for a limited period of time through a temporary buydown of the initial interest rate (aka rate reduction subsidy)

Example of 2/1 Buydown:

- Initial Note Rate: 7%

- First Year: The rate is reduced to 5%

- Second Year: The rate is then 6%

- Third Year: The initial Note rate of 7% is in place for the remainder of the loan term

NOTE: See payment examples on page 4

- Borrowers are qualified at the Note rate, not the “bought down” rate

- Homebridge will accept Seller paid/funded buydowns on purchase transactions only; the following applies:

- Interested party contribution limits apply per program requirements, and

- The buydown funds will be deposited in an escrow account and the Servicer will disburse funds from the escrow account each month to make the complete mortgage payment

- The following temporary buydown features are ineligible:

- Lender paid buydown, and

- Borrower paid buydown, and

- Realtor paid buydown

Temporary Buydown Eligibility

- Homebridge is offering a buydown option on the following loan programs:

- Fannie Mae,

- Freddie Mac,

- FHA, and

- VA

NOTE: A buydown is not eligible on Jumbo Elite, Jumbo/Jumbo AUS, Simple Access or USDA

- Purchase transactions only

- Fixed rate only; ARM ineligible

- 1-4 unit primary residence and 1-unit second home transactions; investment transactions ineligible for buydown

- Buydowns ineligible on manufactured homes

- Available buydowns:

- 1/0,

- 1/1,

- 2/1

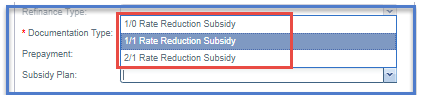

Broker Required Action in P.A.T.H.

When submitting a loan with a temporary buydown feature the following is required:

- On the Short Application page in P.A.T.H. go to the Mortgage Type section and select the applicable buydown type from the Document Type dropdown menu:

- 1/0 Buydown

- Select: 1/0 Rate Reduction Subsidy

- 1/1 Buydown

- Select: 1/1 Rate Reduction Subsidy

- 2/1 Buydown

- Select: 2/1 Rate Reduction Subsidy

- 1/0 Buydown

Loan Estimate (LE) and Closing Document (CD)

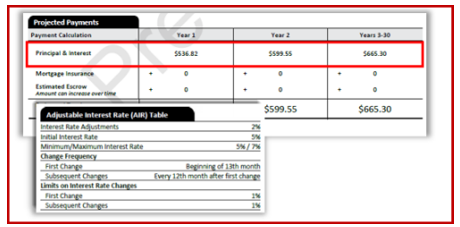

- Loan Estimate: The LE will reflect the following:

- Projected Payments Section: The P & I will show the reduced monthly payment based on the buydown features

- Adjustable Interest Rate (AIR) Table Section: The AIR table reflects rate change information based on the buydown features

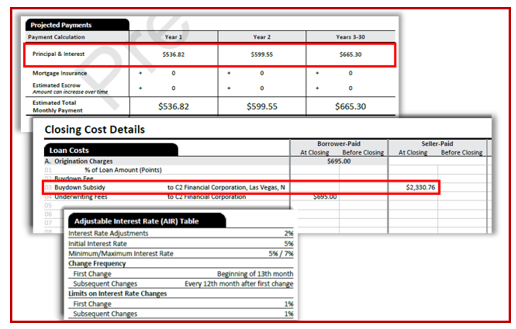

- Closing Disclosure: The CD will reflect the following:

- Projected Payments Section: The P & I will show the reduced monthly payment based on the buydown features

- Loan Costs Section: Section A reflects the cost of the buydown and applies it to the Seller-Paid costs at closing

- Adjustable Interest Rate (AIR) Table Section: The AIR table reflects rate change information based on the buydown features

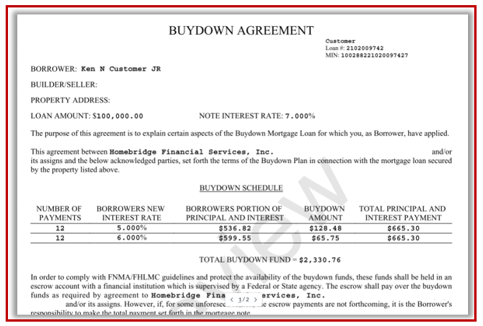

Buydown Agreement

A Buydown Agreement will be provided with the closing documents and must be signed by the borrowers (example below)

Payment Examples

- 1/0 Buydown (aka rate reduction subsidy) with $100,000 loan amount at 7% interest

- Year 1 (1% subsidy):

- P&I payment with 7% interest rate = $665.31

- P&I payment with 6% interest rate = $599.56

- Difference in payments = $65.75 which is the seller’s contribution (subsidy)

- Year 2 (No subsidy):

- P&I payment with 7% interest rate = $665.31

- Seller Subsidy Totals

- Year 1 subsidy paid: 12 months x $65.75 = $789.00

- Total Seller Subsidy Contribution: $789.00

- Year 1 (1% subsidy):

- 1/1 Buydown (aka rate reduction subsidy) with $100,000 loan amount at 7% interest

- Year 1 (1% subsidy):

- P&I payment with 7% interest rate = $665.31

- P&I payment with 6% interest rate = $599.56

- Difference in payments = $65.75 which is the seller’s contribution (subsidy)

- Year 2 (1% subsidy):

- P&I payment with 7% interest rate = $665.31

- P&I payment with 6% interest rate = $599.56

- Difference in payments = $65.75 which is the seller’s contribution (subsidy)

- Seller Subsidy Totals

- Year 1 subsidy paid: 12 months x $65.75 = $789.00

- Year 2 subsidy paid: 12 months x $65.75 = $789.00

- Total Seller Subsidy Contribution: $1,578.00

- 2/1 Buydown (aka rate reduction subsidy) with $100,000 loan amount at 7% interest

- Year 1 (2% subsidy):

- P&I payment with 7% interest rate = $665.31

- P&I payment with 5% interest rate = $536.83

- Difference in payments = $128.48 which is the seller’s contribution (subsidy)

- Year 2 (1% subsidy):

- P&I payment with 7% interest rate = $665.31

- P&I payment with 6% interest rate = $599.56

- Difference in payments = $65.75 which is the seller’s contribution (subsidy)

- Seller Subsidy Totals

- Year 1 subsidy paid: 12 months x $128.48 = $1541.76

- Year 2 subsidy paid: 12 months x $65.75 = $789.00

- Total Seller Subsidy Contribution: $2,330.76

- Year 1 (2% subsidy):

- Year 1 (1% subsidy):

The buydown feature is available for new submissions and pipeline transactions (pipeline transactions require an applicable COC) on or after August 10, 2022.

The Fannie Mae, Freddie Mac, FHA, and VA guidelines have been updated and posted on the Homebridge website at www.HomebridgeWholesale.com

If you have any questions, please contact your Account Executive